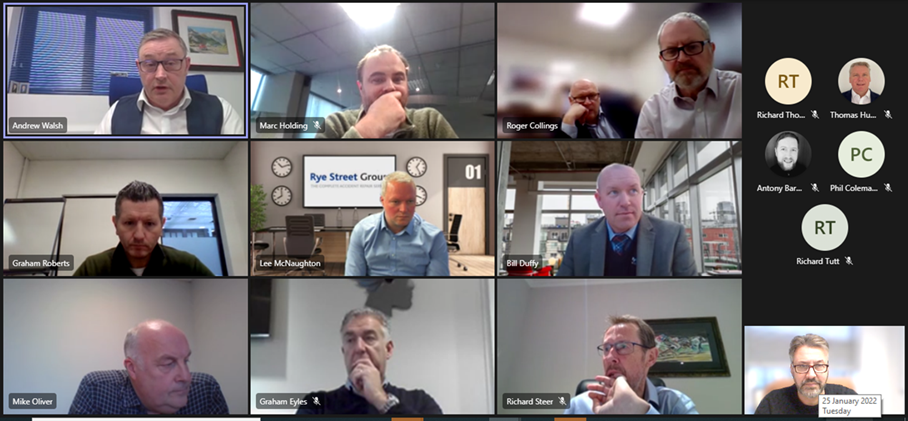

On Tuesday 25 January, NBRA held its first Independent Group Summit of 2022 with owners and leaders from many of the UK’s most influential vehicle body repair groups.

The purpose of this was to gain a collective understanding of the macro challenges currently facing the industry and to structure NBRA’s priority focus of activity for groups.

The meeting strictly observed anti-competition compliance, ensuring that no specific commercial terms or organisations were identified.

Big picture

It should come as no surprise that each of the groups are experiencing extraordinary workload challenges. It was estimated that whilst claims levels are now in the region of 85-90% of pre-Covid levels, repair capacity industry wide is closer to 75-80% relatively. Consequently, all over the country consumers are facing considerable repair delays as a result, with customers who have an accident today often being offered repair dates in mid to end March.

Where has the capacity gone?

There are several factors affecting this:

· Fewer repairers

· Fewer skilled staff – as a result of Brexit and bodyshop staff migrating to better paid industries such as delivery driving

· Extended repair durations -significantly driven by parts availability

· Heavily reduced availability of mobility.

Consensus amongst these respected business leaders is that these issues may persist for the next 18-24 months and that the solutions need to transition from tactical to strategic.

Which part is the biggest cause for concern?

Collectively, the lack of parts availability emerged as a shared priority for NBRA focus. The shortage of semi-conductors and the impact of Covid shutdowns worldwide has had a knock-on effect to parts availability with many items that were once stock, now routinely taking 3-4+ days. It was estimated that across the industry, repairs that would have taken 10 days (keys to keys) are now often stretching to 20.

These delays tie up repair capacity, space, courtesy cars, create dissatisfaction and erode profitability. The groups have called upon NBRA to increase market and consumer visibility of this issue and to create market wide collaboration of all stakeholders to ‘turn up the heat’ on vehicle manufacturers, but also to explore what other options the industry has to better serve its customers.

Keeping the customer moving

Another topic that dominated the debate was mobility driven by the worldwide shortage of new vehicles. With bodyshops unable to buy courtesy cars due to manufacturers prioritising stock to retail customers, combined with rental companies unable to even offer vehicles for hire, customers are experiencing prolonged repair delays and bodyshop profits are being impacted through reduced output and increased costs per repair.

Again, the NBRA Groups are keen to see us pull together a stakeholder working party to surface new ideas and smoother processes. This problem is nobody’s “fault” per say, but bodyshops are often being asked to meet unrealistic promises and feel they are often letting their valued customers down due to a problem outside of their control.

Other challenges

The meeting touched upon other equally important headwinds such as the quadrupling of energy prices (£75k extra for the average shop), increased wage costs, ESG, EVs and the recognition that Q2 2022 may see further bodyshop capacity shrinkage as a result of the macro-economic environment. The sub-text here was the enormous inbound cost inflation being seen with no clear mechanism to offset them.

Summary

NBRA have been given a clear mandate from groups with further meetings to be held for single site shops. These groups have committed to further essential meeting dates throughout the year to include those who were absent for this particular meeting, due to other commitments.

This meeting introduced excellent inter-group collaboration and direction for the key factors that affect the market.