NBRA’s fifth instalment of Membership Spotlight is an extra special one… Anthony Hatch from Cheadle Motor Body Builders has truly got a story to tell!

Name: Anthony Hatch

Company Name: Cheadle Motor Body Builders Limited

Year Established: 1965

56 years, where has the time gone?

This is how long we have been providing our service to our valued clients…

HI, I am Anthony Hatch, managing Director of Cheadle Motor Body Builders Limited formed in 1965 and the longest standing member of the old VBRA and now the NBRA.

Having achieved the 50-year Gold award some 6 years ago, they have kindly asked me for an insight into the company and my 35 years in this industry. Why has it taken so long for them to ask me I hear you say? The answer is simple! I do not know. We must be due another award perhaps!

This is just part of our story. Forgive me if I whittle on a bit, it’s all part of the makeup of this industry and if you get bored you can always return to the online shopping. Anyway…now I have your attention it can only go downhill from here and as there is no fee, I may blow my own trumpet a bit.

I will always remember a meeting taking place (we had them regularly in those days) with the VBRA when all members agreed to increase hourly rates fairly for repairers to be able to work together with the insurers and be able to run profitably. This was as close as we have got to having some sort of regulated fair rate I can remember for the good of the industry. This was to be reviewed on a yearly basis between relevant representatives. There was one problem. A large body shop in their wisdom undercut this rate with an insurer on the quiet, thus starting a domino effect that has lasted until the present day. Have we learnt any lessons from this in over 30 years? I fear not.

I think Covid -19 has proved with Nationwide, the fine lines that we are operating to in this industry.

The best bits of advice I can remember, is to know your market and do not commit to non-profitable contracts just to fill your shop, it is no good being a busy fool as the old saying goes!

Easily said than done in this industry

My Dad Jim, a legend in the insurance Engineering world for arguing over hours in the old days (whom some of you may remember if your old enough) started the business and retired some 15 years ago. He was on his way out well before that though (not in that way) when technology reared its ugly head and computers started to appear in body shops for the first time, which gave me the ominous opportunity to leave the shop floor to embrace this new technology. It also gave Jim the opportunity to buy a caravan in wales where to this day, he still spends most of his time fishing.

We had one of the first bodyshop management systems back in the day written in DOS before windows was even invented and was still an idea in the head of Mr Gates. I remember the tedious hour long backing up sessions with 2 boxes of 3-inch floppy discs. Over the years we have invested a lot into technology and, through experience, developed bespoke systems for the way we want to operate.

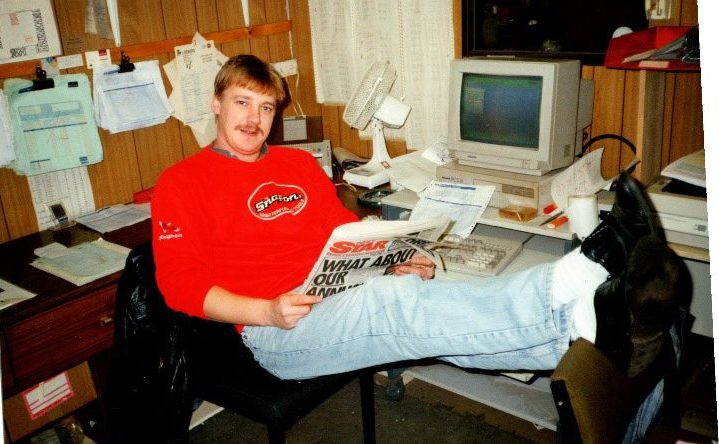

Picture of, a very young me (left), undertaking a long back up session with the old Olivetti PC.

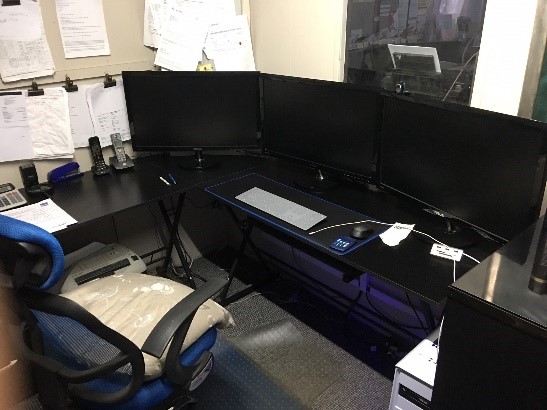

And one of the Offices today (right).

Where did all the work go?

However, back then was also a time when the insurance companies first started to look at putting volume work into larger repairers starting with Direct line, who we had been working for from when they were first formed. Ironically, after winning the CIS approved repairer award for Greater Manchester and their Engineers assuring us there was no way CIS would let us go, we knew change was coming like a steam train with no brakes when a letter arrived which read, ‘thanks but no thanks!’. After over 20 years, we were no longer wanted. This was a massive blow for us.

The writings on the wall

We were an appointed repairer for most insurers at that time, there were no so-called “volume shops” to speak off then, their clients had a choice of garages. We had bent over backwards for the CIS, their offices were down the road from us, and we would often pop in to pick up claim forms for their clients and pinch a coffee from their machine. We knew the writing was on the wall with many insurers now following this route. They didn’t care about the service we had provided, something had to be done. Should we have to risk quality and invest heavily to expand, to be given more work for lower rates, with more overheads at this unpredictable time? risking our reputation? or not? Some did, and many went under, with insurers casting them away without a glance only for another body shop to take the bait in the hope of success.

We made the decision to downsize, sold one of the buildings and committed to providing a quality service above quantity knowing it was going to be a fight to survive. With our client base built over many years we felt we were making the right decision to give it a go and have never looked back with increased margins and reduced overheads.

Big Is Beautiful?

Not a chance, I don’t want to be big (I’m big enough with all the takeaways I’ve had during the pandemic) I’ve lost enough sleep worrying over the years! I don’t want to lose sleep at night, I need sleep! Sleep is important to me, and… I’m not as young as I was. Small is beautiful.

There is no secret to what we do, but it is something that cannot be copied by large volume repairers where massive turnovers must be met (or not) to survive, because the fact is, they cannot give the personal one to one service that smaller repairers can or should. If the customer is happy, they will spread the word! Especially in this day and age. Social media is a massive platform where clients will (not might) express their views. If they can upload a picture of their dinner, you can be sure they will comment on a good or bad repair undertaken on their second biggest outlay and insurers are starting to realise now their customers are getting a voice.

Is it still a battleground for smaller repairers like us?

Stand by your rates and know your margins, because smaller repairers just don’t have the volume to reduce these, a good insurer understands this and will work on behalf of their clients wishes (they may even re-insure with them next year!) now there’s an idea. I do have some great relationships built up over many years with a lot of insurers and engineers and our reputation certainly helps, but do the insurers really want us in the chain? You tell me. With many insurers now increasing, client’s excesses as another way to prize them away from us when they legally choose to use us (no discounts to those nasty insurers). We must be on the ball all the time with this, with many customers totally unaware of this clause when we ask them. Like Jim before me, arguing over the hours in the old days. Will the haggling or tricks ever stop?

Engineers

I like you! It is not all your fault we have a war on rates. Many are monitored and have targets (not that sort please! come on!). They have a difficult enough time doing their job. I also find it unbelievable how many I have spoken to over the years who admit they would exercise their right to choose their own repairer if they personally had to make an insurance claim on their own vehicle. Funny that?

The customers are the ones that will keep our business going

They are the ones that will use you again if they are happy. They are the ones who will let their friends know about you, and their friends and you guessed it, their friends. You only get one chance to convince your customer when they come through your door that your place, is the only place, they want their vehicle repaired.

As an owner I am lucky enough to make this interaction possible and our staff are taught the importance of treating our customers with respect and courtesy. We take the time to discuss the work and estimate with the client and promote our company’s ethics, quality, service, and standards. When we get the job, we can then back it up with our end product. For us it’s not about doing 10 estimates and maybe getting one, it’s about getting every job we can. Now I know that’s not possible, but we like to think we have done everything we can to secure a result and it’s not just another wasted estimate walking out of the door.

This approach can be tiresome but having the ability to talk in a friendly manner and have literature designed in house to hand out with the estimate is key. Why not advise a customer what their insurer will try and do to take the job away and that it is their right to a repair with you? Afterall, their vehicle is probably their second biggest purchase after their house (or a Caravan!).

I know we are a bit of a niche repairer because our staff have remained loyal and are all highly qualified to do more than one job. We are lucky in respect that we do not have a high turnover of staff. I started on the shop floor and trained in panel work and painting. I went on the paint courses when they used to take you abroad to the factory with that free beer fridge, well I was young! (some will remember those days). So I know from experience the other side of the business which has helped me in the management side of the company to no end.

It seems like I hate volume repairers!

Nothing can be further from the truth, it is a tough task, I just hate what is happening in this industry and the blinkered approach, as I mentioned at the beginning. I know it will never happen, but if they all stuck to rates they deserve and came together, they wouldn’t need their carparks full to operate and they could manage the operations more efficiently with less stress, whilst taking more time on the jobs and produce a better service for their customer. The extra work instead of being parked for weeks could then filter down the chain to say…. Me! (oh, my lord, we better get that building back)

The worse time, a Covid reception

I must mention the pandemic and a year I would sooner forget, which incidentally was good news for the car insurers, with insurance premiums still being paid to them and a massive fall in accident claims. Maybe a good time to mention an increase in rates to help us all out? Well, I will not lie to you.

Yes, we had to shut.

Yes, we had to furlough.

Yes, we lost a lot of revenue.

Yes, it will be a struggle to get back to where we were before.

Yes, I lost someone I knew from Covid.

And yes, I did think about calling it a day (I still might if an offer was good enough).

But we will carry on though, we will turn things around and we will have an obscene amount of sanitiser left after Covid. What I can assure you is this… We will not deviate from our commitment to continue to offer our valued customers a fantastic bespoke repair service with that personal touch for the foreseeable future, or when that caravan comes a calling.